Resource Taxes

So it seems that taxing oil and gas is the only significant result that’s going to come out of the Henry Review, and that probably means I should work out an actual opinion on it.

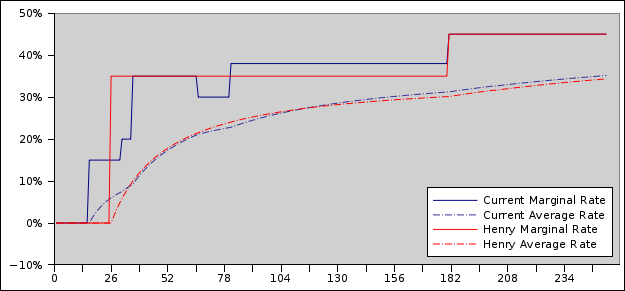

As I understand it, the Resource Rent Tax as proposed by the review is meant to be a different way of charging for non-renewable resources extracted from Australia — coal, oil, gas, uranium, whatever. The aim being to increase the government’s share of the value, while maintaining profit incentives to actually find, extract and sell it. And the way the Henry review recommends achieving that is for the government to make themselves 40% partners in the investment, with their initial capital contribution being made by tax concessions, and then receiving dividend payments worth 40% of profits via the tax system. See Nicholas Gruen’s take for more on this line of thinking.

Of course, the government’s cheap — it’s not going to actually put money up front to become a 40% partner like anyone else would; it’s obviously hoping to get all the benefits without any of the risks. But that’s not economically sound — it would mess up the incentives for investment, effectively making investing in Australia 66% more expensive [0].

(And, of course, the government’s not going to be an ordinary investor either — just buying shares in mining companies would be way too straightforward…)

Instead the government’s contribution is in the form of payment of the state taxes and tax deductions, and because that’s not as valuable as actual money, their payback only kicks in when the endeavour starts making lots of money (where lots is defined as more than you’d make just loaning to the government).

On that basis the maths would go like this: in the first year you spend $3B to setup a mine, but don’t make any revenue yet. The government gives you $2B in tax credits you can use later (or possibly against other projects you’re working on). Your mine starts production, earning its first $1B ($1.5B in revenue, 500M in expenses). You then owe $280M in company tax, and another $288M in resource tax. You deduct those from your tax credits. You can presumably then pay out $432M as fully franked dividends to your investors; I’m not sure about the remaining $568M (if it’s not, $568M in unfranked dividends is equivalent to about $400M in franked dividends, the difference going to the government via the investors’ income tax). Anyway, that goes on for three and a half years or so until your tax credits have been all used up — you’re either paying out $1B in dividends a year to your investors (a 33% return) and no tax, or $832M in dividends (28% return) and $168M in tax (16.8% of earnings). After the three and a half years are up, you switch to $432M in dividends (14.4% return) and $568M in tax (56.8% of earnings). Presuming the initial investment is entirely unrecoverable (the trucks you bought wear out over the life of the mine, it’s cheaper to demolish the buildings and rebuild than try moving them to your next mine, etc); that would mean over the first three and a half years investors recover either 110% of their investment or 97% of their investment, and then earn a 7% return.

With just company tax, the same scenario would have resulted in $700M in fully franked dividends each year (23.3% return), so investors would get 93.3% of their money back after four years, and then earn 23.3%.

Except, of course, things aren’t actually that simple either, because, AIUI, some of the ongoing costs will get counted as well, so the $500M in annual expenses might mean up to an additional $333M in tax credits each year, which would not be very sound — but if some of those expenses are for “expanding the mine” they possibly should be counted as additional “investment”. Additionally, interest is earned on unspent tax credits at the government bond rate, but that would be pretty insignificant in the above example. And it’s possible the government doesn’t plan on providing tax credits worth 40% overall, but only puts in 40% of the previous investment (which would be worth 28.5%).

There’s also the “super profits” aspect — I can’t see how that’s intended to be calculated. It could be simply via the interest rate on unspent tax credits: if you’ve got $2B in tax credits, and earn the 6% bond rate on that for an additional $120M in tax credits, then you could just spend the “interest” to reduce your $288M annual resource rent liability to an $168M annual liability in perpetuity. The $120M saving then is the resource rent tax (40%) on the non-super part of the annual profits (6% of 5B). Of course, if you work things that way, you don’t have the few years of no/low tax. I wouldn’t have thought the tax office would let you work things that way, either, to be honest; but economically it’s probably meant to be treated as an equivalent outcome. Anyway, that totals to a 55.2% tax on annual earnings in the above example.

Beyond that there’s the effect on risky projects. If a mine doesn’t turn out to make money, at the moment you lose lots of money. With the government being a 40% partner, you still lose that money, but you get 66.6% of it back in tax credits. And if you didn’t “lose” the money, so much as paid your nephew (or subsidiary company, whatever) to do some prospecting for you, well, hey, that’s pretty neat, right? The risk there is pretty simple: the government wants to be counted as an investor in all the profitable mining companies, without actually exercising any judgement on what’s likely to be a good company and what’s not. And if you’ve got an investor with no judgement, people are going to take advantage of that.

Of course, being the government you can write the laws to your own advantage — so you can claim all the profits when things go great, and disclaim any losses when things go bad. That seems to be the Greens plan:

Resources Minister Martin Ferguson said the government was committed to keep a controversial plan to reimburse miners for 40 per cent of their losses.

But with opinion polls predicting the Australian Greens gaining the balance of power in the Senate after the next election, the government may have to scrap this.

Greens leader Bob Brown has said that while he supported the resource profits tax in principle, he did not want miners being rebated for their losses.

That goes directly against the positioning of the government as a “co-investor”, though, compare to Ken Henry’s reported comments or Terry McCrann’s expansion from senate testimony.

And really, nothing in the calculations above actually had anything to do with resources — just investment; you can invest in a restaurant too, and except for scaling down the numbers, the same calculations and arguments would apply. If it was really about the resources, it would make more sense for the resources themselves to be government’s initial contribution [1] to the investment. But that just goes straight back to charging royalties on whatever’s dug up, which is the system we’ve already got.

As far as sovereign risk goes, that seems a pretty simple calculation. After, what, 30 years of Hawke, Keating, Howard and Howard 2.0 Rudd, people might’ve expected pretty simple and sound economic policies — floating the dollar, privatising the banks, independent reserve bank, compulsory superannuation, the GST, free trade agreements, low inflation, gradual lowering of income tax rates, pretty good handling of the Asian currency crisis in the ’90s and the recent financial crisis. What are the odds the government will suddenly start doubling the amount it taxes various companies? Before the “super tax”, you might’ve said pretty low. Now, not so much. Will it happen again? Who knows — but I bet more people would guess it would now, than would have previously. So yeah, Australia’s sovereign risk seems way higher.

Ultimately, this is looking more and more to me like one of those ideas that sounds great at the height of a boom (“look, those people are making lots of money, gosh I wish we were those people!”), but that turns out too clever by half, and all the little complexities involved in turning theory into practice end up biting you in the butt.

[0] If (eg) you currently have to invest $10B in setup costs for every $2B profit per year your mine makes; then with the government taking 40% of that, $10B would only get you $1.2B in profit. To get $2B in after-resource-tax profit, you’d need $3.3B in before-resource-tax profit, which would mean a $16.6B in setup costs; a 66% increase.

[1] Though that runs into the “which government?” problem — the resources are owned by the states, and it’s the federal government that wants to collect more money… And that in spite of the state governments having the bigger budget problems at the moment…

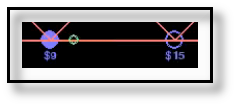

In the example that should hopefully appear at the right, we’ve got two visible markets (represented by blue circles), and an agent who can carry goods from one to the other (represented by the smaller green circle on the red line). There are three other agents connected to each of the markets, but we’re not concerned about them for the time being. The agent might already own some goods, which could either be stored at one or the other of the markets, or be being carried right now.The agent can move between the two markets (which takes some time), possibly carrying some goods. While at a market, the agent can drop off any goods being carried, or pick up some goods to carry.

In the example that should hopefully appear at the right, we’ve got two visible markets (represented by blue circles), and an agent who can carry goods from one to the other (represented by the smaller green circle on the red line). There are three other agents connected to each of the markets, but we’re not concerned about them for the time being. The agent might already own some goods, which could either be stored at one or the other of the markets, or be being carried right now.The agent can move between the two markets (which takes some time), possibly carrying some goods. While at a market, the agent can drop off any goods being carried, or pick up some goods to carry.